Healthcare fell out of favour with investors following the pandemic, but a brighter earnings outlook and strong, long-term tailwinds have renewed interest. BlackRock explain why adding exposure to healthcare may be beneficial this year, despite the impacts of potential US political pressures.

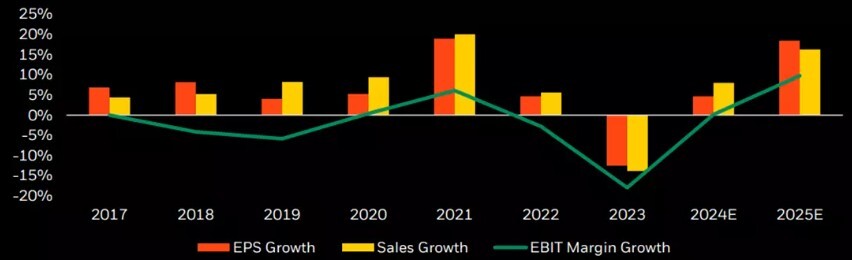

Earnings in recovery

As we entered 2024, the healthcare sector began transitioning back to a more stable earnings profile after the most severe earnings recession in its history, which culminated in 2023. While the pandemic led to unforeseen profits for COVID-19 vaccine producers and research labs, these earnings then dramatically receded as the world recovered from the pandemic (see chart below).

Global healthcare earnings inflection

Source: BlackRock, FactSet, December 2024

Last year, an average of 75% of healthcare companies exceeded earnings expectations in the first three quarters of the year – the highest percentage of all global sectors, including technology. As a result, BlackRock saw local investor sentiment in the sector begin to recover in 2024, with around $80 million of inflows to the iShares Global Healthcare ETF (IXJ) last year – within their top 20 exposures for the year on an inflow basis.

Looking to 2025 projected earnings, the sector is expected to rebound even further, recording the highest year on year growth in 18 years (excluding during COVID-19). So far, in the US healthcare has been one of the best performing sectors in the S&P 500 Index for the year to date.

Innovation and regulation

Political changes in the US have understandably created investor nerves that the rosy outlook for the sector could be negatively impacted this year.

While leadership within key federal agencies will no doubt shape regulatory agendas around issues like vaccines, drug approvals and pricing, BlackRock think immediate or drastic policy changes in the US are unlikely due to existing checks and balances.

For instance, vaccine mandates are determined on state and local levels in the US, with the federal government acting in an advisory capacity only, and in order to remove a vaccine or drug from the market, scientific inadequacy must be proven in the courts.

More broadly, they believe the regulatory agenda of the new US administration could lead to more flexibility around healthcare mergers and acquisitions, potentially easing scrutiny on patents and delivering sector-wide benefits.

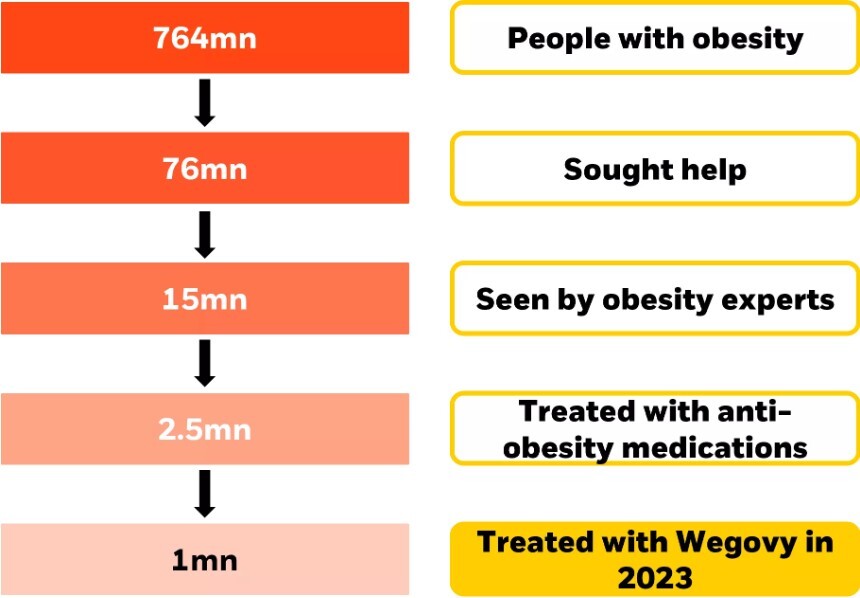

Beyond regulatory issues, BlackRock think innovation in areas like obesity medication, surgical robotics and oncology will continue to drive growth in healthcare this year. Glucagon-like peptide-1 agonists, or GLP-1s, have emerged as one of the most significant and contemporary therapeutic trends influencing the healthcare landscape in recent years.

Despite a 2000% increase in GLP-1 users from 2021-2023, only 0.1% of qualifying obese patients worldwide are so far using GLP-1s, indicating a huge ongoing runway for customer take-up (see chart below). Expanding into offering the medications orally could also slash manufacturing costs for providers, with almost half the weight loss drugs currently in development being in tablet form.

GLP-1 penetration of obesity

Source: Novo Nordisk, December 2023

Additionally, robotic assisted surgeries continue to be a strong growth story, with the global surgical robotics market expected to grow by US$16 billion over the next seven years. Oncology is also a hotbed of innovation, with over 100 new cancer treatments including antibody and cell therapies expected to launch within the next five years, driving nearly US$400 billion in pharmaceutical spending by 2028.

A balanced diet in your portfolio

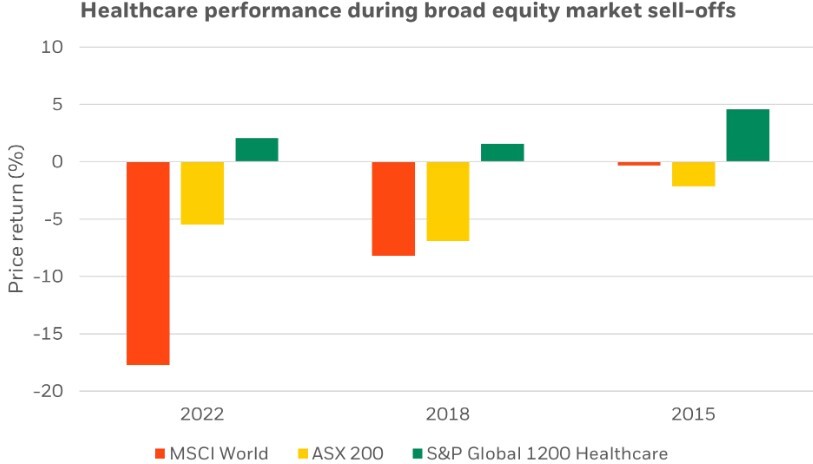

As well as benefiting from a number of long-term growth trends, adding global healthcare exposure to a portfolio can help to boost diversification and potentially reduce volatility when broad equity markets sell off.

Investors with an existing portfolio of broad Australian and global equities will typically have less exposure to healthcare on a relative basis. For instance, the ASX 200 Index is made up of approximately 10% healthcare stocks versus 19% materials and 34% financials, while the MSCI World Index has 11% healthcare exposure compared to 25% technology and 17% financials.

Healthcare exposure may also be useful to consider for investors with less tolerance to short-term volatility in their equity allocations. Well known as a defensive sector, it may help to offset negative returns in a share market downturn – as seen in the chart below, which shows the index tracked by the iShares Global Healthcare ETF (IXJ) outperforming in the last 3 calendar years where global equity markets generated a negative return.

Source: MSCI/S&P/BlackRock data, as at 31 January 2025. Past performance is not a reliable indicator of future performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

With the sector poised for significant growth and transformation, as well as being a useful defensive play and portfolio diversifier, BlackRock believe healthcare is well worth investor consideration in 2025.

Source: BlackRock